At the same time, the higher the risks, the more caution is needed when developing a medicine. In this process, failure is one of the absolutely natural outcomes. This Bio Insight introduces the current status of the development of medicines for cancers and Alzheimer's that are in the limelight around the globe.

◆ "Cancer Immuno-therapy" as a flagship, blockbuster new medicines

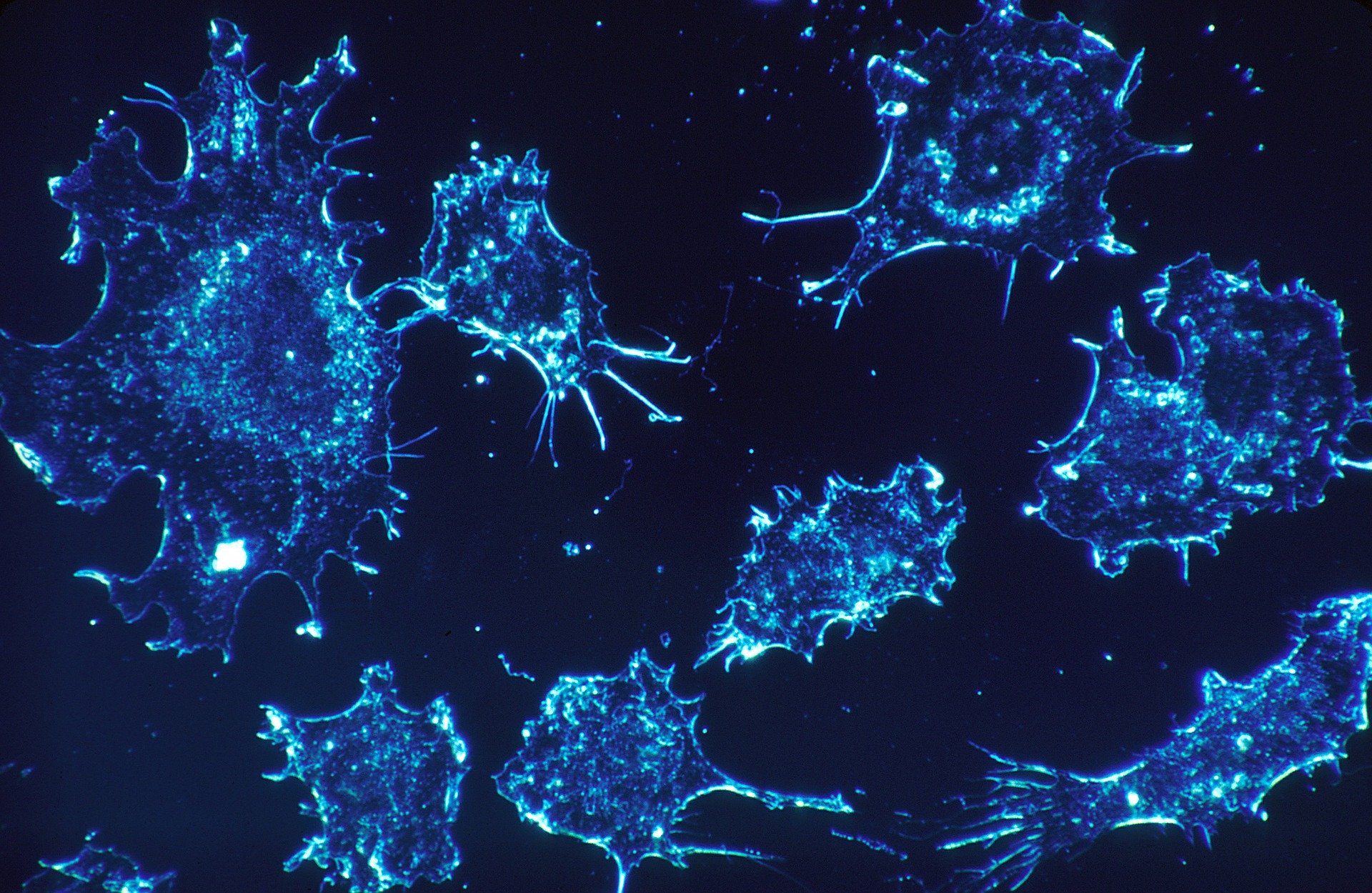

Since the emergence of the first drug for cancers in the 1940s, diagnostic technologies and medicines have made enormous strides, but cancers have still not been conquered. If detected at an early stage, they can usually be cured. In reality, however, in certain types of tissue the likelihood of detecting cancer in the early stages stands at less than 50%. And for advanced cancer, especially after it has spread to other tissues, the survival rate declines dramatically and it still a frequent cause of death.

To overcome this, there has been continuous research on medication. It all started with the first chemical anticancer drug developed in the 1940s. It has been effective in disrupting the growth and fission of cancer cells, but it also attacks normal cells. Having said that, it has been used steadily due to its high treatment effects in the inhibition of cancer cell growth and fission, leading to the development of numerous generic drugs.

Faced with the technical limitations of the chemical anticancer drugs, research regarding next-generation medicines emerged at the US National Cancer Institute (NCI) in 1971. After 30 years of such research, second-generation target-specific anticancer drugs came along in the 2000s.

To overcome this issue, an anticancer drug based on the human body's immune system has appeared. Immuno-therapy can fundamentally reduce rejection reactions as a patient's T-cells are extracted and re-injected into the body. CAR-T (Chimeric Antigen Receptor-T), which is known as the flagship technology for cancer immuno-therapy, binds a CAR receptor with a T-cell and CAR-T cells are injected back into the body. These re-injected CAR-T cells inhibit cancer cells by engaging in an antigen-antibody reaction with the cancer cells.

However, immuno-therapy also has its shortcomings. It is highly effective in blood cancers, but it tends to be less effective for solid cancers like lung cancer due to "T-cell deactivation factors." CAR-T itself has adverse effects called Cytokine Release Syndrome (CRS). As an attempt to address these issues, research is currently being carried out on CAR-NK, using NK (natural killer) cells that are relatively cheap and have no known side effects.

Generally speaking, six to seven years of clinical trials are required on average in the development of new medicines, but it takes 10 to 15 years for anticancer drugs. Despite that, there is still extensive research in progress for anticancer drugs due to their high profitability. According to "World Preview 2019, Outlook to 2024" published by EvaluatePharma, about 700 million dollars are required for each clinical trial of an anticancer drug, but its NPV (net present value) stands at 78.2 billion dollars, considerably higher than those for other indications in the cardiovascular system, central nervous system or musculoskeletal system.

On top of that, thirteen global firms are working to organize pipelines from the perspective of portfolios to minimize clinical risks. There are more pipelines for expanded indications where the risks of clinical trial failure are lower than pipelines for a new medicines using innovative materials. In terms of technical fields, pipelines tend to focus on technologies that have resulted in market release of many products such as micro-molecular target therapy, immune checkpoint inhibitors and therapeutic antibodies. In the fields of cell therapeutic products, anticancer vaccines and anticancer viruses, on the other hand, only one or two pipelines remain for research, or there are no pipelines at all.

In the case of expanded indications, normally a clinical trial can be carried out from phase 2 or 3. The pipelines are concentrated in phase 3 clinical trials. For a new medicine based on innovative materials, the pipelines are comprised of mainly phase 1 clinical trials.

According to Korea Pharmaceutical and the Bio-Pharma Manufacturers Association (KPBMA)'s analysis on the "pipeline status of South Korean pharmaceutical firms," there are 573 pipelines in the nation including leading/candidate materials, out of which 178 are for anticancer drugs. Out of the pipeline composition in South Korea, discovery and non-clinical stages take up a higher proportion than phase-1 clinical trials. In terms of expanded indications, there has been no case in which a new medicine has been developed.

Clinical trials of phase 1 or higher in the pipelines of major pharmaceutical firms in South Korea are normally carried out domestically, and there are ten clinical trials currently being conducted at the FDA. However, the clinical trials of Sillajen and HLB failed and were suspended. Except for incrementally modified drugs like Hanmi Pharm's Oraxol of and biosimilars, there is no phase 3 clinical trial for a new medicine in the pipelines at the FDA. Due to reasons such as these, it is expected that it will take quite a long time for any anticancer drugs developed by domestic firms to be released into the market.

Due to the botched clinical trials of Sillajen and HLB, stock prices of biotech firms in South Korea plummeted across the board in 2019. Given the nature of this sector with a low clinical success rate, however, failure is one of the naturally expected outcomes. Rather, we need an ecosystem in which the performance of any individual company does not negatively affect the entire industry.

◆ Go through a one percent possibility for Alzheimer's

Alzheimer's is a major degenerative brain diseases that causes brain cells to deteriorate. It was named after a German doctor (Alois Alzheimer) who discovered the disease in 1907. After more than a century, there are still difficulties in developing a medicine to treat the disease.

This has been echoed in the results of clinical trials. Namenda, a new medicine containing memantine approved by the FDA in 2003 is the most recent success. Since then there has been a failure after failure in phase 2 and phase 3 trials and even final approvals have a failure rate of 99% or higher, making it the hardest disease to combat successfully.

Global pharmaceutical firms are also having a difficult time. In 2018, Pfizer announced that it would stop developing a medicine for dementia. This announcement came after the failure of clinical trials of Dimebon in 2012. In addition, other firms including Eli Lilly, Merck and Axovant Sciences have also decided to suspend the development of treatments for Alzheimer's.

Unlike cancer cells, brain cells cannot be extracted for research during a clinical trial. As human samples of Alzheimer's are normally extracted from brains of dead patients, information about the progression of the disease is very limited. In addition, in the case of research done on rats and other animals, there may be a gap in the accuracy of the data acquired as animal brains are different from the human brain.

However, pharmaceutical firms have not yet given up. Relevant research regarding amyloid β accumulation inhibitors and binding antibodies is continuously being pursued. In particular, Biogen announced its planned re-application for FDA approval on aducanumab, after the suspension of its clinical trial this past March, increasing the possibility of having the very first medicine able to slow down the deterioration of cognitive capabilities caused by dementia.

Furthermore, there are other research activities being conducted to develop medicines for dementia, using various mechanisms such as amyloid β, tau proteins involved with tangled nerve fibers, 5-HT6 (serotonin) receptor antagonists or metabolic medicines (insulin, pancreas hormone, etc.) and growth hormones.

With regards to domestic pharmaceutical firms, their pipelines for new medicines for Alzheimer's are primarily focused on phase 1 and phase 2 clinical trials, but research is also being carried out with the goal of being first to market for a medicine with high growth potential. A case in point is the research on a new, natural-substance medicine being carried out by Kwang Dong Pharm, SK Chemicals, Whan In Pharm, and Hanwha Dream Pharm while Daewoong Pharm, Medifron and Neuro Tech have continued the development of new medicine composites and Medipost is focusing on the development of stem cell products. Since the development of Alzheimer's medicine has a very low success rate, a increasing number of global pharmaceutical firms, biotech start-ups, universities and research institutes are engaged in collaborations to pursue it.

In the sector of diagnostic contrast media, some domestic firms have made their names known all over the world. Contrast media are a class of drugs administered into tissue or blood vessels before image diagnosis, in order to make the imaging results more visible on CT, MRI or PET scans. In the field of diagnostic contrast media for Alzheimer's, AMYViD was first approved by the FDA in 2012, followed by Vizamyl approved in 2013 and NueraCeq in 2014.

Specialized in radioactive contrast media in South Korea, 2017 FutureChem became the 4th company to add its name to the list. The firm's Alzavue, a diagnostic contrast medium for the target diagnosis of Alzheimer's, obtained approval from the FDA, leading the promotion of research activities in the relevant industrial and academic circles.

Investments in R&D that support all of this have continued. Major advanced nations have expanded their budgets regarding research on dementia including Alzheimer's and have strengthened their infrastructure. In the United States, President Obama announced his "Brain Initiative" in April 2013 and revealed a brain map development plan together with the National Institutes of Health (NIH) and the National Science Foundation (NSF). Under this plan, a total of three billion dollars will be invested over the following ten years.

The United Kingdom provided 112 billion KRW for research on dementia in 2014 and 2015, pushing ahead with a joint project (Cross-council) among research institutes. France has supported large-sized research institutes, L'Agence nationale de la recherche (ANR) and universities with 450 million euros annually for the past five years. In addition, in countries like Japan and the Netherlands, the national governments have operated a brain bank and established infrastructures.

Global firms are active in research, using various mechanisms and, on top of this, the market of early-diagnostic devices is expanding.

In South Korea, universities make up about half of the nation's R&D capacities with respect to Alzheimer's, followed by state-funded research institutes and small- and medium-sized enterprises. Basic research takes up the highest proportion of the overall R&D stage, and recently the R&D stage has been steadily expanding.

The size of the government's investment in R&D has been steadily increasing up until 2018 when it encountered a downturn. Alzheimer's is a disease that generates enormously high social costs, but domestic firms have limitations in developing medicines alone. Thus, it is necessary to continuously provide support for R&D and establish a research infrastructure. Relevant research enterprises, research institutes, universities and hospitals should actively engage in convergence of their research activities.

Reference

Trends and implications of anticancer drugs development at home and abroad (KDB Future Strategy Center)

Alzheimer‘s diagnosis/treatment technology (KISTEP's Technical Trend Brief No. 2019-13)

댓글 정렬